The number of ‘crypto native’ and traditional businesses that transact with digital assets has seen unprecedented growth in recent years. This adoption of a new asset class has necessitated an increased focus on accounting for tax reporting and operations management purposes; however, international accounting practices continue to evolve, and the systems required to convert on-chain activity to the general ledger are developing in lockstep to the blockchains they monitor.

The ultimate goal of the Statement of Digital Assets (SoDA) is to provide a lasting and transparent bridge between accurate Generally Accepted Accounting Principles (GAAP) reporting of digital assets and the details from multiple wallets, centralized exchanges, and other cryptographically-based ownership and/or custody arrangements. We started with the balance sheet because of the importance of treasury to crypto-native businesses.

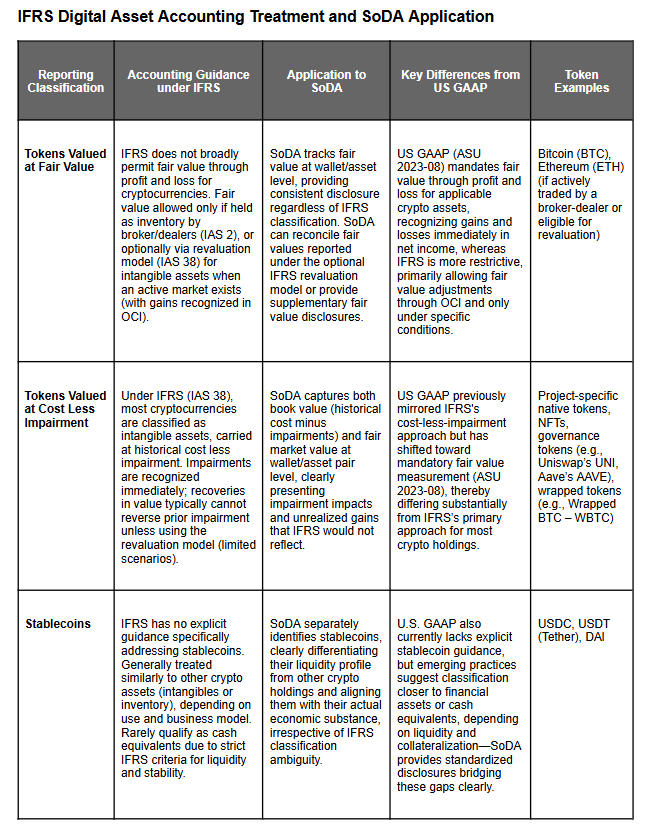

The IASB still has not issued specific stand-alone guidance for accounting for cryptocurrencies under IFRS. Reporting entities must continue to rely on existing standards – primarily IAS 38 (for intangible assets) and IAS 2 (for inventories) – depending on the purpose of the crypto holdings. The 2019 IFRIC Agenda Decision provides some interpretative guidance (notably that cryptocurrencies are generally intangible assets, not cash or financial instruments), but the evolving nature of digital assets means this area remains in flux and will likely require further attention by the IASB. In the meantime, adopting a supplementary, non-authoritative reporting framework like SoDA can help bridge the gap. SoDA’s granular wallet-and-asset-pair disclosures can be layered onto IFRS financial statements to provide investors and auditors with the detail and transparency that current standards omit – all without conflicting with IFRS requirements.

SoDA’s core framework offers a structured, consistent and adaptable approach to digital asset reporting across multiple jurisdictions and reporting frameworks. By maintaining atomic-level detail, SoDA provides businesses with the granularity needed to ensure accurate tracking and reporting while allowing for jurisdiction-specific adjustments. As the regulatory landscape continues to evolve, SoDA serves as a foundational tool for bridging global accounting standards and establishing best practices for the Web3 industry.