As of 11 February 2025, the number of financial institutions licensed by the Monetary Authority of Singapore (MAS) to provide Digital Payment Token services has surpassed 30, and it continues to grow. With Bitcoin reaching an all-time high, there is increasing demand to verify the existence and ownership of cryptocurrencies (crypto) in financial audits and attestation reports.

Unlike traditional financial assets held in banks, crypto assets exist across multiple blockchains, making historical balance verification and ownership confirmation complex. Tokens may evolve, have near-identical counterparts, or exist simultaneously on different chains. In Web3, many entities manage their own wallets, eliminating the need to rely on third-party confirmations.

CRYPTO EXISTENCE IN AUDITS

To verify the existence of crypto assets at a specific point in time, auditors can use tools such as:

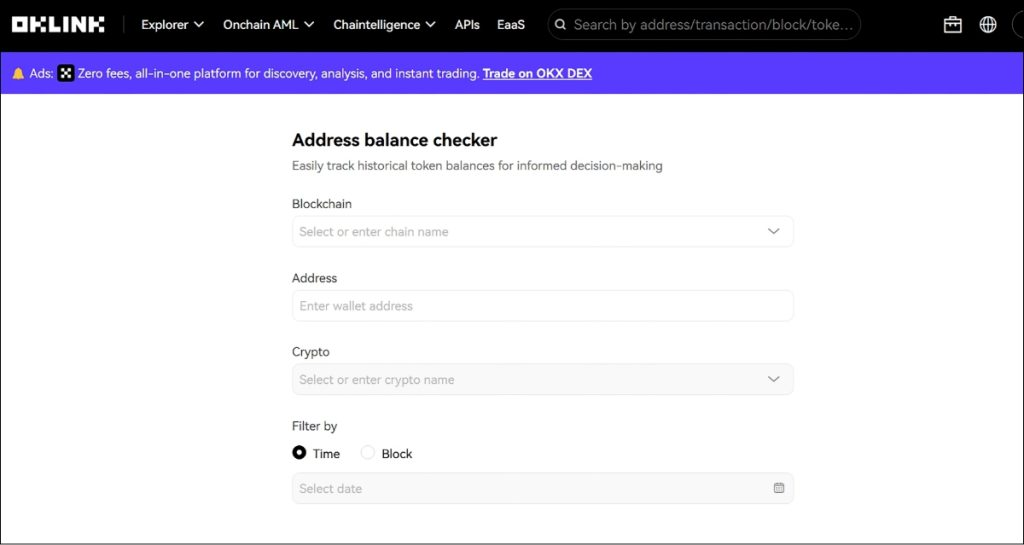

- Oklink – Historical balance checker;

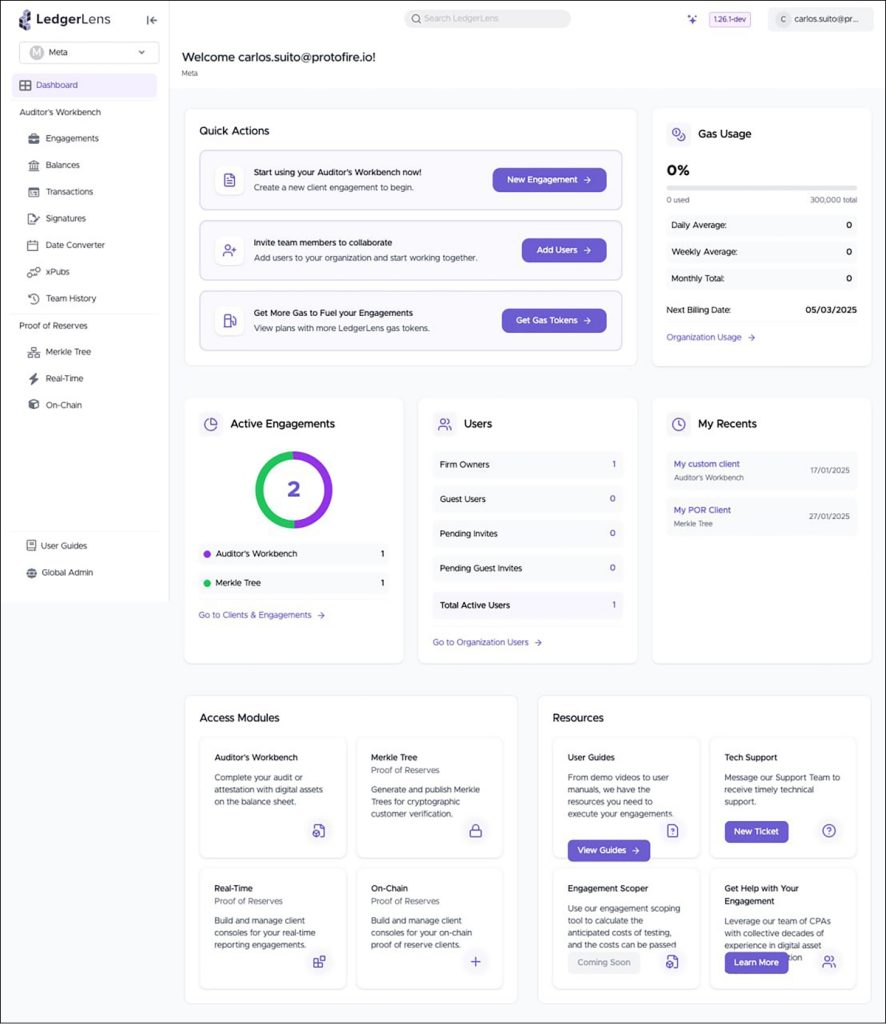

- LedgerLens – A digital asset audit and attestation suite designed for auditors; and

- Debank – Portfolio tracking tool.

Selecting the appropriate tool depends on the specific chains and tokens within the audit scope.

OWNERSHIP FOR CRYPTO AUDIT

Ownership verification is crucial in crypto auditing. Since private keys control crypto holdings, auditors should ensure that clients implement best practices, including multi-signature addresses, encryption and secure storage, to mitigate risks.

Two useful methods to prove crypto ownership are:

- Transaction test: Instruct the client to send a specified amount of crypto to another wallet, demonstrating control over the assets.

- Digital signature test: Instruct the client to sign a specific digital message, verifiable via LedgerLens (LedgerLens is a digital asset audit and attestation suite designed for auditors).

CONCLUSION

As the crypto industry evolves, audit methodologies will continue to develop, with regulatory guidance expected as the market matures. Until then, professional scepticism remains crucial, and auditors must stay informed about emerging technologies and industry best practices.