One particular sector of digital assets has captured growing interest due to their unique properties: Stablecoins. In a market prone to extreme volatility, stablecoins are digital assets designed to maintain a stable value relative to a specific asset or basket of assets, most commonly the U.S. dollar. Functionally, they represent collateralized deposits on-chain, with the vast majority backed by fiat currency reserves.

Stablecoins are proving to be “crypto’s killer app” and achieving product-market fit. These metrics portray the scale of adoption and usage that stablecoins have garnered at an aggregate level, reflecting their importance for both on-chain infrastructure and the global financial system. With over $230B in supply and more than 1.5M in active addresses, stablecoins now drive 60%+ of all transaction volume across blockchain networks. Their role has expanded beyond just being a medium of exchange, serving as stores of value, payment rails, and a key channel for global dollar access.

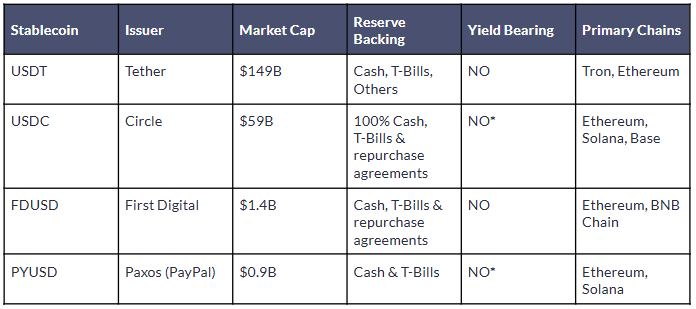

Fiat Backed Stablecoins:

Tether’s USDT stands out with the largest market share, driven by its first-mover advantage, offshore regulatory positioning, widespread distribution in emerging markets, and deep liquidity, factors that have created a powerful network effect that has proven difficult to displace. Circle’s USDC follows, showing impressive growth after its March 2023 de-pegging, supported by strategic distribution via Coinbase and Binance. Meanwhile, PayPal USD (PYUSD) is still in the early stages of adoption as it works to scale by leveraging its platform.

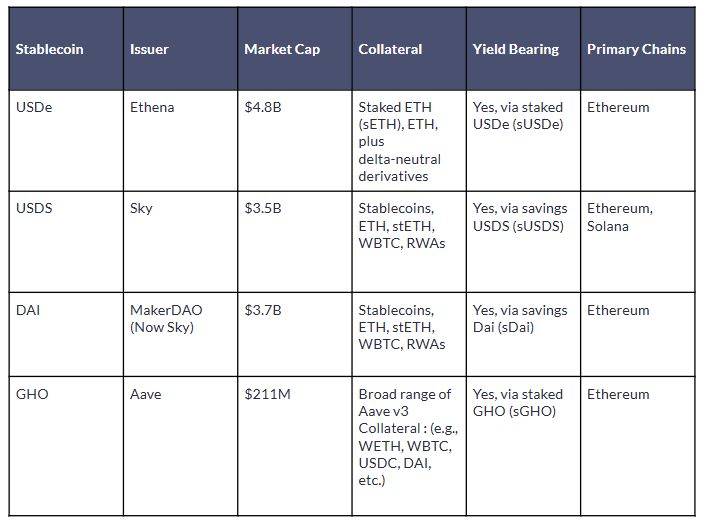

Crypto-Collateralized Stablecoins:

Crypto-collateralized stablecoins provide an alternative to fiat-backed models, leveraging different issuance mechanisms and risk profiles. The subsector represents a smaller but growing segment of the market, accounting for approximately 7% of total stablecoin supply. Unlike fiat-backed assets, these stablecoins are minted and burned via smart contracts, reducing reliance on centralized custodians, but introducing smart contract and governance risk in return.

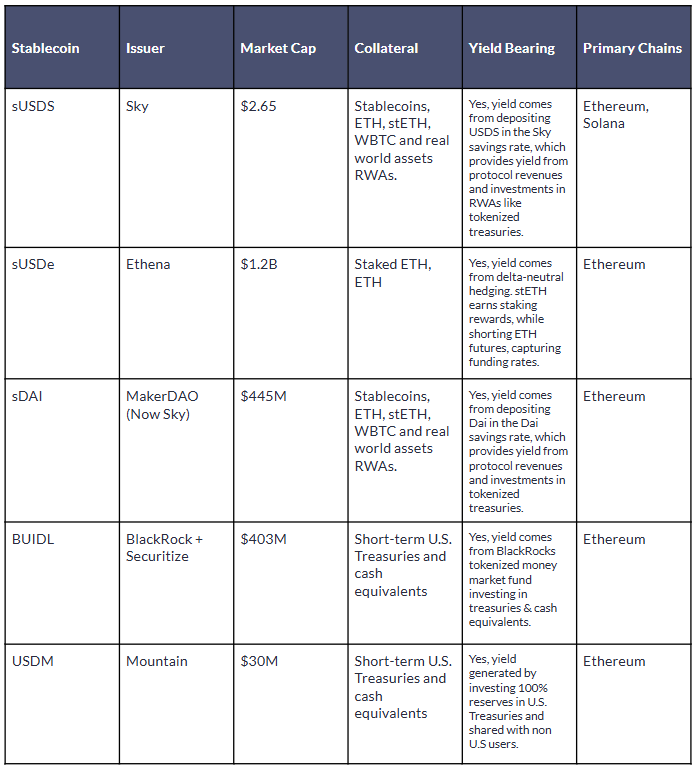

Interest-Bearing Stablecoins:

The post-2021 rise in federal funds and global interest rates introduced an opportunity cost for pure U.S. dollar exposure. This sparked the emergence of interest-bearing stablecoins and tokenized money market funds (TMMF) collateralized by short-term U.S. treasury bills, money market instruments, and other real-world assets (RWAs). The issuers of these stablecoins, ranging from decentralized to centralized, return a portion of yield generated to holders, keeping the “net-interest margin”.

As stablecoins increasingly dominate on-chain activity, the biggest beneficiaries of this growth are the blockchains they’re issued and transacted on. A larger share of stablecoin supply and activity can boost a chain’s relevance, drive user retention, and deepen ecosystem liquidity and value capture. This has made stablecoins a strategic battleground for Layer-1s and Layer-2s alike.

By comparing transaction count and median transfer size across chains, distinct usage patterns emerge:

- Solana exhibits high frequency, low value stablecoin transactions, enabled by its low transaction fees and high throughput architecture.

- Ethereum displays lower frequency, but higher value transactions, reflecting its dominance in DeFi and real world asset (RWA) activity.

- Base lies in between, with greater variability in transaction frequency and transfer value, showing traction in both retail and DeFi segments.

- Tron features a higher volume and median transfer value than Base, driven by USDT’s widespread adoption and network effects.

The network share of stablecoin transfer volume was previously dominated by Tron and Ethereum. However, going into 2024, Solana and Base have captured a growing share of activity as stablecoins proliferate in their ecosystems. As of April 2025, 37% or adjusted transfer volume takes place on Ethereum, 35% on Base, followed by 20% on Tron and 5% on Solana.

Conclusion

Stablecoins are evolving from merely trading tools into a foundational component of finance. With over $230B in circulating supply, they now serve as mediums of exchange, savings instruments, and key channels for global dollar access across both centralized and decentralized ecosystems.

As regulation begins to take shape and new entrants diversify the market, stablecoins are increasingly serving as the connective layer between crypto-native infrastructure and real-world financial applications. While fiat-backed stablecoins dominate, the growth of interest-bearing, crypto-collateralized, and tokenized money market models is expanding user choice, each with trade-offs around risk, transparency, and decentralization.

At the same time, blockchains are competing for stablecoin volume by offering lower fees, and optimized infrastructure. This is driving stablecoin adoption on-chain adoption and enabling use cases like payments, remittances, and micro-transactions at scale.