In our last post we showed a glimpse of the stablecoins 2030 estimates,

Today’s post is about exact regulations + technology architecture explained using heat map for each use case.

Key insights from the report 👇

Exact regulations,

– Stable Issuers must maintain 1:1 USD or T-bill reserves, publish monthly reserve audits & comply AML/KYC rules (as per GENIUS Act).

– Issuers holding > 50B USD in reserves must file US GAAP audited financials.

– Tax treatment, Stablecoins = Property ✅ and not money❌, any Gains/Loss – trigger Form 1099-DA reporting.

Use cases explained with heat maps showing integration of stablecoins,

It’s no brainer that the best use cases of stablecoins are cross-border payments (A) and Trading (B).

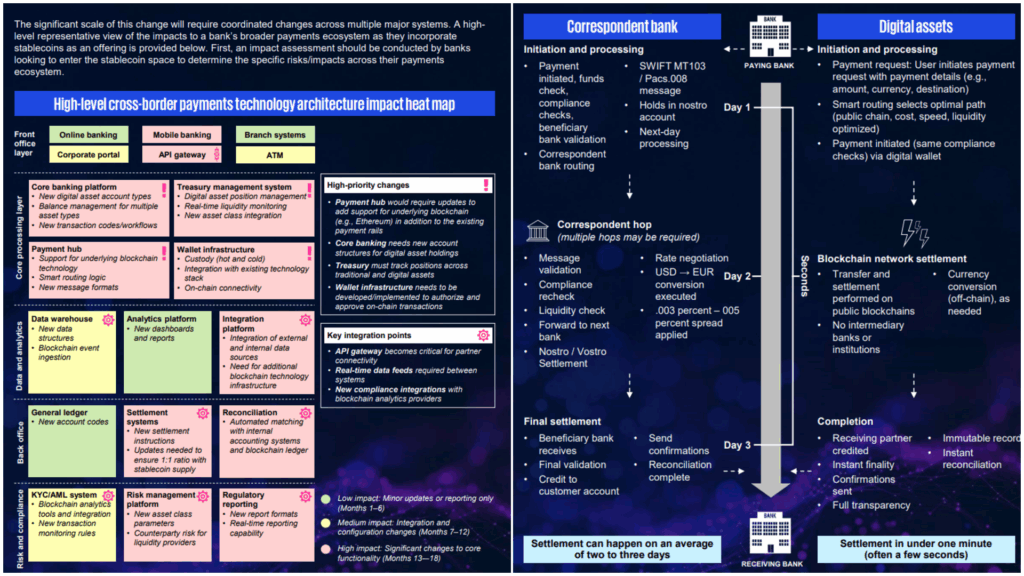

A) Cross border payments + Stablecoin integration:

– Front office layer: online banking, mobile app, etc

– Core processing layer: smart routing logic, wallet Infra, etc.

– Data and analytics: dashboard and reports, data sources, etc.

– Back office: new accounts, reconciliations, etc.

– Risk and compliance: KYC/AML sys, regulatory reporting, etc.

Detailed heatmap below showing stablecoins integration in banking system:

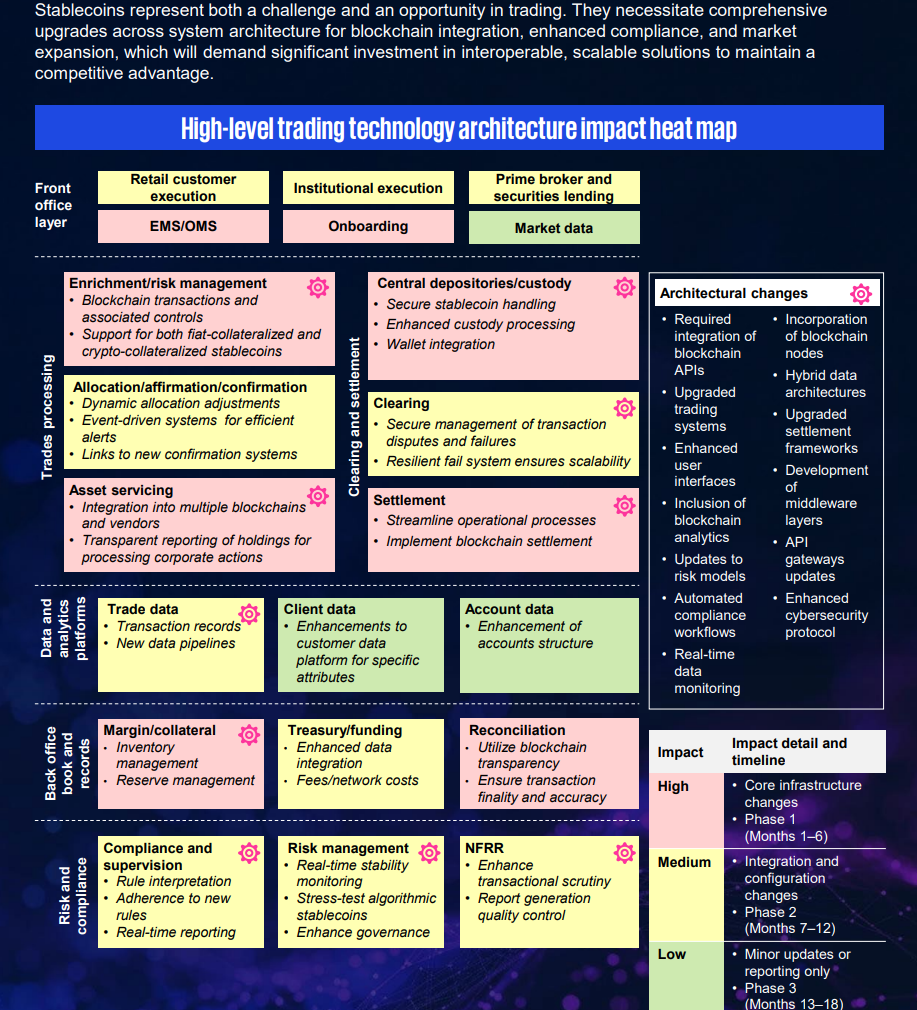

B) Trading + Stablecoin integration:

💡 Migration to T+0 settlement (not at T+1 or T+2).

– Front office layer: onboarding, retail/institutions, order management etc.

– Trade processing: allocation, custody, clearing, settlement etc.

– Data and analytics: trade data, client data, etc.

– Back office: margin management, reconciliations, etc.

– Risk and compliance: regulatory reporting, security etc.

Detailed heatmap showing stablecoins integration in Trading:

📌To give you a perspective, market facts:

“JPMorgan settles 2B USD daily via its blockchain platform” ~ J.P. Morgan, Introducing Kinexys, November 2024

“PayPal’s stablecoin (PYUSD) has crossed 1.17B USD Mcap.” ~ www.coingecko.com